Lottery Rules Canada

Accordingly, all gambling is generally criminalized in Canada (see section 206). After initially criminalizing all gambling, the Criminal Code, in the next section (s. 207), sets out exceptions. Activities which are provincially-licensed and regulated are deemed to be legal gambling. There are two national lottery games that are operated in Canada. Out of all of them, the Lotto 6/49 is the most popular and it is the first nationwide lottery game in the country that allowed its players to select their own numbers. American Tax Laws. There are no income taxes on Canadian lottery winnings for Canadian citizens. Canadian tax authorities do not consider lottery earnings to be taxable for purposes of Canadian income tax. Winners are required, by American law. As quoted in this news article “ In June, after consulting with the Inter-Provincial Lottery Corp., the national organization that oversees Lotto Max across Canada, BCLC told the lawyer only an individual or group, and not a trust or corporation, could claim a prize and the winners must go public, according to BCLC and ILC rules.

Buying Canadian Lottery Tickets Online

The Canadian Lottery

To start playing online, visit Lottosend lotteries page

There are two national lottery games that are operated in Canada. Out of all of them, the Lotto 6/49 is the most popular and it is the first nationwide lottery game in the country that allowed its players to select their own numbers. The previous national lottery games, which included Loto Canada, Olympic Lottery and Superloto, all had numbers pre-printed on their tickets and players couldn’t pick their own numbers. That type of lottery was gradually phased out in Canada thanks to the Lotto 6/49. The winning numbers for this game are drawn out every Wednesday and Saturday by the Interprovincial Lottery Corporation and it is conducted with a Smartplay Halogen II ball machine. Until 2009, the second national lottery game was the Lotto Super 7, but it was then replaced with Lotto Max. There are also some provincial Canadian lotteries conducted in different areas of the country including Quebec, Ontario, British Columbia, Western regions and Atlantic regions.

You may also like to read:

HowtoBuyUSAPowerballTicketsOnline:

Many people are glad to spend money on an online lottery ticket because it is an excellent opportunity to win a few million. If you compare this amount with a future gain, it is a small fee.Readmore…

Knowing the Canadian Lottery Rules

There are some basic rules that you have to be aware of when playing the Canadian lottery. First, you have to be 18 years of age for participating in any of the national lotteries. Secondly, you don’t have to pay any income tax in Canada when you win a prize, whether you are a resident of the country or a non-resident. However, you should be familiar with the tax laws in your country regarding your lottery winnings if you are playing from outside of Canada. In addition, you should also bear in mind that if you win a big prize in the lottery or the jackpot, it may have to be collected in Canada.

Guide for Playing the Canadian Lottery

The rules of the Lotto 6/49 are quite straightforward as the name of the lottery is self-explanatory itself.

- Six numbers are chosen by the players from a range of 1 and 49 and matching all six numbers lets you take home the jackpot.

- Apart from the six main numbers, a bonus number is also drawn and if a player matches five numbers and the bonus number, they can take home the second prize.

- For the Lotto Max, seven numbers have to be chosen from a total of 49.

- Other than the primary jackpot, this lottery game also includes the auxiliary ‘MaxMillions’ prize of about $1 million each and it is rolled over until it is won.

You may also like to read:

Canada Lotto 6/49:

How to Play and Win the Most Popular Canadian Lottery From Anywhere In The World!

How Can I Win the Canadian Lottery?

Whether you choose to play the Lotto 6/49 or the Lotto Max, the game is all about numbers. The choice of numbers can have an impact on your odds of winning a prize in any lottery. There are different methods that can be used for selecting the numbers. You can choose to go with totally random picks by letting the computer choose the numbers for you. Another option is to do some research and see what numbers are prone to being drawn more frequently than others and including those in your selection. Never choose numbers in a sequence and it is best to use a combination of high and low numbers to ensure you are getting the best of both worlds. Even if you don’t match all numbers, you can still take home a second or third prize.

Canadian Lottery Payouts

Lost Lottery Ticket Rules Canada

The original Canadian lottery’s jackpot rarely surpassed the figure of CAD$10 million, but things have changed since then. Now, the minimum amount of the jackpot is around CAD$4 million and it can go higher than CAD$25 million. As a matter of fact, the biggest single jackpot in Canadian history was given on October 17th, 2015 and was worth $64 million. The ticket was bought in Mississauga, Ontario. As for the Lotto Max, it has a jackpot cap of $60 million as of July, 2017.

Second Tier Prizes

Your chances and prizes for matching the numbers to the draw are highlighted here:

- Matching five numbers plus the bonus ball has odds of 1 in 2,330,636 and the prize is 6% of the total Pool Fund.

- Matching five numbers wins you 5% of the Pool Fund and the odds are 1 in 55,492.

- Matching four numbers has odds of 1 in 1033 and your prize is 9.5% of the Pool Fund.

- Matching 3 numbers wins you $10 and the odds of are 1 in 56.7. Matching 2 numbers and the bonus balls has odds of 1 in 81.2 and you win $5.

- Matching 2 numbers has odds of 1 in 8.3 and you win a Free Play.

You may also like to read:

How to Buy Mega Millions Tickets Online:

Purchasing the tickets is extremely simple and a lot of fun too.Readmore…

History of the Canadian Lottery

In 1973, the Olympic (1976) Act was passed, a Quebec corporation by the name of the Organizing Committee of the 1976 Olympic Games was authorized for running a lottery scheme. The purpose was to raise money for the Olympic Games to be held in Montreal and could sell tickets in any province as long as their government agreed. The Western Canada Lottery Foundation was established by Alberta, BC, Manitoba and Saskatchewan in 1974 under the Canada Business Corporations Act and in 1976, the Interprovincial Lottery Corporation was constituted.

Buy Canadian Lottery Tickets Online

The rules for playing the Canadian lottery online are no different than the traditional way. You have to follow the same guidelines, but the only difference is that you buy your tickets while sitting at home and it doesn’t get lost as you have a digital copy in your email account. You are notified when a draw is conducted and if you have won anything. Moreover, you can find amazing discounts and bundles when buying Canadian lottery tickets online.

Online Canadian Lottery Syndicates

Another huge perk of playing Canadian lottery online is your ability to participate in existing syndicates. Yes, syndicates can also be formed via the traditional method, but you have to do the effort of asking people to join and manage the syndicate. This hassle is eliminated with online syndicates and you are still able to improve your chances of winning the Canadian lottery as others have done.

To start playing online, visit Lottosend lotteries page

Related Posts:

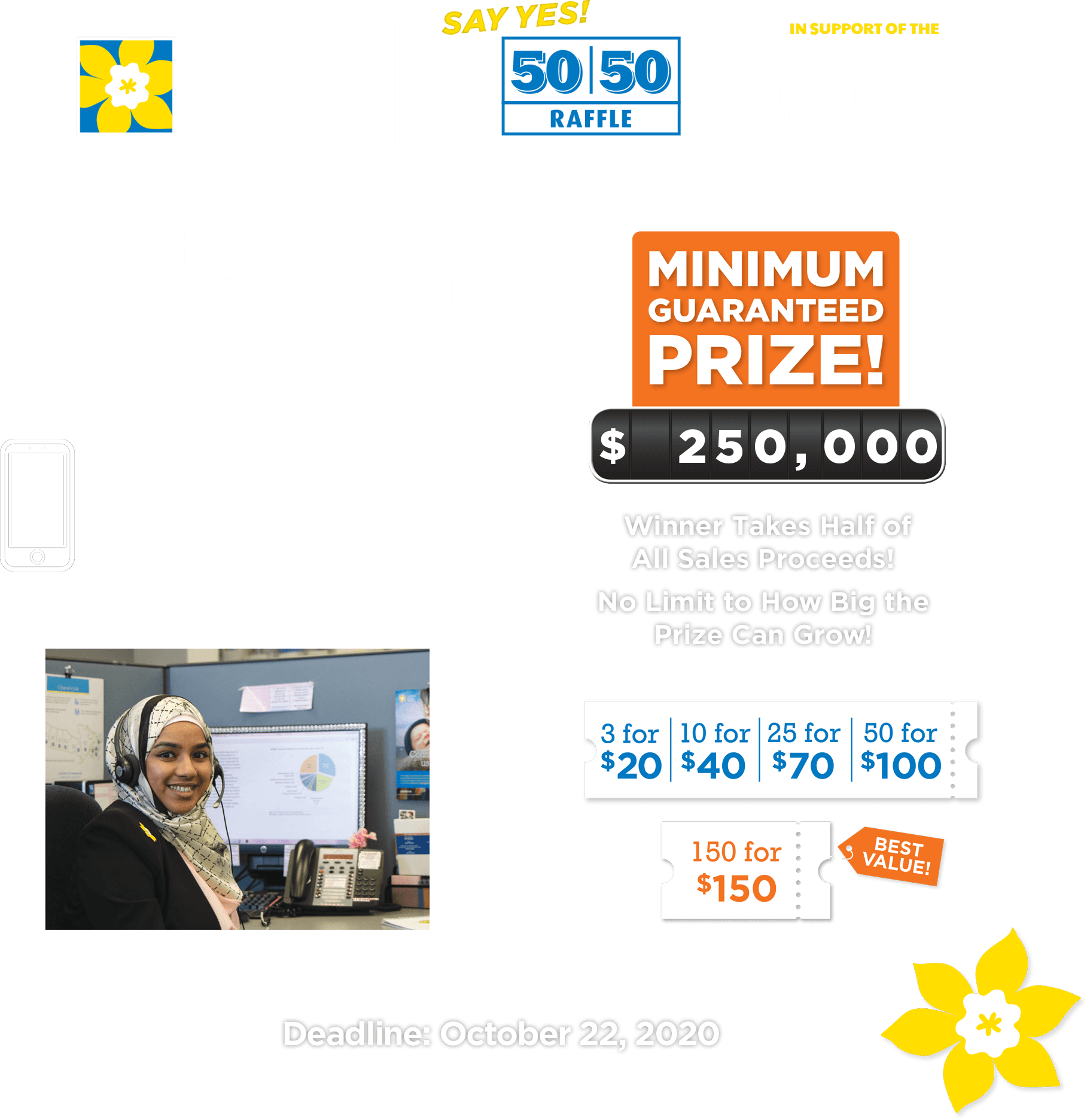

A raffle lottery is a scheme whereby tickets are sold for a chance to win a prize at a draw and includes 50/50 draws, elimination draws, and calendar draws.

Provincial Licence

Only the Registrar may issue a licence to an eligible charitable or religious organization for the following:

- Raffle lotteries where the total value of the prizes to be awarded exceeds $50,000;

- Raffles conducted in an unorganized territory;

- Raffles conducted on federal land such as Canadian Forces Bases;

- Raffles lotteries where the event is to be conducted in conjunction with another licensed lottery event;

- Electronic raffles.

Municipal Licence

A municipality may issue a licence to eligible local charitable or religious organizations for paper raffle lotteries where the total value of the prizes to be awarded does not exceed $50,000.

Municipal licence applications may be made with the municipality where the event will be administered.

If you are applying for a municipal licence, contact the local municipality where the event will be administered for more detailed information on the application process, licensing fees and required attachments.

Lottery Rules Canada

Blanket Raffle Licence (issued by municipalities only)

A blanket raffle licence will allow eligible organizations to obtain one lottery licence to conduct and manage more than one type of raffle event within a fixed time period and within a capped prize amount.

Please refer to the AGCO’s Lottery Licensing Policy Manual for further information pertaining to blanket raffle licences.

Application Requirements:

- First time applicants should visit the Charitable Lottery Licensing Overview page for information on what’s necessary to determine eligibility

- Municipal approval letter (if applicable)

- Please refer to Raffle Application Requirements for Lottery Licences Issues by the Registrar, linked below, for complete details on additional documentation required

- Appropriate lottery licensing fee payable to the Minister of Finance.

Where the licensee wishes to extend ticket sales or hold the draw outside the municipality where the event will be administered, the licensee must notify each municipality in which it wishes to extend its operations. Such request shall be in writing and include a copy of the licence issued, as well as a copy of the original application submitted. Permission to extend ticket sales into municipalities other than the municipality where the event is administered will be considered for municipalities in the Province of Ontario only.

The licensee must conduct and manage the event in accordance with the Terms and Conditions of the licence.

Application Forms, Reports, Terms and Conditions

Raffle Application Requirements for Lottery Licences Issued by the Registrar (For use when applying or reporting to a municipality or First Nation with an Order-in-Council)

Application to Manage and Conduct a Raffle Lottery (For use when applying or reporting to a municipality or First Nation with an Order-in-Council)

Lottery Report (For use when applying or reporting to a municipality or First Nation with an Order-in-Council)

Application to Manage and Conduct a Blanket Raffle Lottery (For use when applying or reporting to a municipality or First Nation with an Order-in-Council)

Blanket Raffle Lottery Report (For use when applying or reporting to a municipality or First Nation with an Order-in-Council)

Electronic Raffles

Organizations licensed under this framework may use computers in the sale of raffle tickets, selection of raffle winners, and distribution of raffle prizes within the parameters of that framework.

Lottery Rules And Regulations

Electronic raffle solutions developed by your Charity/Organization must be reviewed and approved by the AGCO’s Technical and Laboratory Services. Please use the Electronic Raffle Solution Review Form to submit your proposed solution for assessment and email the form to lotterylicensing@agco.ca.

Documents and Publications:

Catch the Ace

A Catch the Ace progressive raffle lottery is a multiple-draw game in which participants purchase tickets for a chance to win:

- A percentage of the proceeds from the sale of tickets from one draw, and

- The draw winner also gets a chance to win a progressive (cumulative) jackpot by selecting a card from a standard deck of 52 playing cards.

Documents and Publications:

Powerball Lottery Rules

- Application to Manage and Conduct a Raffle Lottery (For use when applying or reporting to a municipality or First Nation with an Order-in-Council)

- Catch the Ace Raffle Report (For use when applying or reporting to a municipality or First Nation with an Order-in-Council)